This is a copy of the analysis I provided to members of my forex mentor group before the markets opened on Sunday 27th October. There had been big moves the previous week and inexperienced traders will have been looking to jump in to trades now. I cautioned against and explained why after 10 years of trading I have learned to be patient and disciplined and wait for price to pullback, either to enter for a continuation move OR a possible reversal.

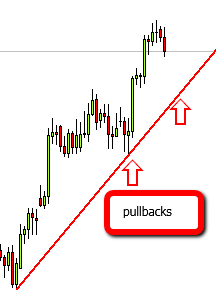

In the chart to the left you can see how on a previous occasion price pulled back to the trend line giving a great entry that was with the trend, THE most conservative way to trade.

Its now Tuesday evening as I write this update so the 2 most recent candles have occurred after Sundays analysis.

You can see in the following notes and the video WHY I felt this move would occur and why I recommended to wait.

I am waiting and hoping for price to pull back to or very near to the trend line.

Here is the blog post, notes and video where I explained my strategy for the week ahead. Learn how to see these type of moves in advance.

Hi, well my 2013 theory that the Ecb & Fed have contrived to keep the Euro/$ below 1.3700 failed to work last week. In my defence, the far better paid honcho’s of Deutsche Bank initially told their customers that the pair would finish the year at $1.20, then revised to $1.25. Finally on Friday they ate humble pie and admitted they got it wrong.

Now as I like a good conspiracy theory 🙂 I am still of a mind that the Euro will not stay at these dizzy heights and therefore I will not long it in the current position. Unless price pulls back to my preferred area then I will leave it alone this week.

The French government, amongst others, are reported to be pushing for a weakening of the Euro. There is a Fed statement this week which could give some $ support and various ECB finance ministers, any of whom could make a dovish comment and we swing back down again. SO caution is the word of the week BUT I do have some potentially decent trades on my radar including one with a potential 1:5 risk reward ratio.

There are lots of technical clues on many pairs (Macd divergence being a big clue) that the recent rises against the $USA are due for at least a pull back so in general that is what I will be looking for. If you are new or want to brush up on technical analysis, see my detailed study of the Aud in today’s video.

Gap Trading: A word of caution if you are looking to trade gaps at the market open. Historically my worst results have been when the clocks change forwards and backwards. This weekend is the end of the sequence and it will mean gaps will be less reliable than usual. If there are any don’t be too aggressive. If you are new or need a refresher you can find my gap trading method here:Gap Trading

Watch those calendars carefully for news (I use Forex Factorys and you can find it here: CLICK HERE, especially “red flag” and don’t get too attached to a trade. The BIG scheduled announcement this week is the Fed, but always check up to date news before taking trades.

Gbp/$: Prefer this over the Euro, though still need a pull-back. There has been a fairly constant drip drip of positive news out of the UK in recent weeks so fundamentally this seems to have more reason to be soaring versus the $USA. From a technical perspective we have had a break out from a weekly triangle and a break of the monthly 55ema, first time since 2008 so it does look very bullish. I don’t like trading when price is at extremes so I need a pull back.

I show in the video why 1.6070 is my chosen area for multiple reasons: trend line, fib, previous support & resistance and monthly 55ema now swinging upwards. One note of caution is that we have Macd divergence on the daily chart. This could be the clue we need for a pullback. If it breaks that area and that trade loses I will long again at 1.600

Euro/$: Illogical to me that its still going up and making new highs. There is still lots of negative news coming out of the Eurozone and the PIIGS issues may have quietned down lately but they have nOT gone away. As soon as any re-appear I expect the Euro to fall. I will not long it in the current position and if it doesn’t pull back I will leave alone this week. If you are going to trade it then a pullback to 1.3600 looks interesting for multiple reasons: trend line, 61.8% fib, whole number and previous support and resistance.

The more conservative area is 1.3500

Chf: Broke and closed below strong support at 0.9000 so technically we need a pullback to short. I am not overly confident as its directly correlated to the Euro and there is macd divergence on the daily. I will not place a forward order, but will watch for clues on a 4 hour chart.

Euro/Gbp: Even more illogical than the Euro/$ to me. Price broke and closed above 0.8500 so technically a pull back to long from there should be the plan. I aim to be more conservative. I will short at 0.8700 if it gets there, for lots of reasons and long at 0.8430

Aud Had a major run up from my suggested entry at 0.8900 last month. This pair is at a crucial area right now and I show in detail in the video my thoughts and plan for this pair. There are lots of clues that we could be on for a decent pullback. Macd divergence, stochastics, 5/8 crossing, back below daily 200ema and monthly 55 BUT its sat on a strong daily trend line that goes back to August. I show in the video how I will short if price breaks on a 4 hour chart. Also I will look to long again if price drops to 0.9400. Final option is if it continues back up then conservative entry is a break and close above the daily 200ema followed by a pullback

$/Yen: All over the place at the moment and further complicated due the Bank of Japan possible intervention as explained in the video. 98.66 has been key but broken regularly in recent weeks, leaving alone for now. Better traded from a weekly chart at the moment. We have a big triangle break brewing which could be worth a 1000 pips! Technically we should wait for such a break on a weekly chart, however a more aggressive entry on a daily would be the smallest chart I would go down to.

Out of the Yens I prefer the Euro this week.

Euro/Yen: Possible 1:5 risk reward on this pair: 132.00/132.30 support line is key, previous support and resistance, whole number, fib and emas just below. I am only interested to long so that’s the area. If it breaks there I will leave it alone.

Aud Yen: Very similar scenario to the Aud potential trend line break, but I prefer that as it has a much better risk reward. If this pair pulls all the way back to 90.00 then I will long.

Cad: 5 out of 6 weeks running I have had decent wins at the major area of 1.02750, and a further win shorting at 1.0420 (see previous posts for explanations as to why). Fridays candle broke and closed above 1.0420 but again I need a pullback and 1.0300 is the area for me now for multiple reasons. Also if price breaks back down below 1.0400 I will be interested to short from 4 hour charts. The one doubt? I never had such a good run on the Cad in 10 years of trading!! I know that sounds silly, but the “Loony” is a strange pair and prone to whipsawing, BUT if it comes to my areas I will trade it.Gosh I can be so butch some times 🙂

New members please note: If I am looking to take a trade long, at for example 1.5000 , I place my order 10 pips above & 10 pips below for a short. This is because price often does not quite reach a major line and you need to allow for spreads.

We are NOT a “tipping service” our aim is to teach you how to trade for yourself. For more up to the minute updates do not forget to drop by the forum

Pierre, Vassilis (Capsmart), Raa, Omar, Mary, and other experienced members will be available in the forum to give you a more up to the minute assessment & whether they see any potential trades lining up in the next few days. Many members tell me this is the best forex forum there is (no back biting & bitchiness, nor spam, that spoils most forums) and all members are happy to help new visitors. Its a great resource, USE IT

To View the Video full screen, click on the square shape, bottom right hand corner.

Author: Marc Walton

0 Comments